How to choose Payment Gateway for Online Store

As online business and activities boomed in recent years, online payments have become a significant part of the e-commerce industry. Credit and Debit cards, Wallets, UPI, are different modes of online transactions supported by payment gateways.

What Is A Payment Gateway?

A payment gateway is a process that connects your bank account to the platform where you want to make a transaction. It is a technology that accepts credit and debit card purchases from customers. As a third party between the merchant and the customers, it takes money from party A and transfers it securely to party B. It also generates messages once the payment is transferred. Some platforms take per-transaction percentage or monthly fees to process a payment. At times customers do not do Online Payments but make a transfer directly to Bank or on a Phone or Cash/Cheque these are Manual Payment Gateways.

How Does a Payment Gateway Work?

Payment gateways are the software that transfers sensitive information from acquiring banks to the issuing banks. It shows if the transaction is approved or declined. Now let’s see how it works once we add items to the cart and hit the checkout button on an e-commerce online store:

1: The buyer securely makes a payment through a credit card on the merchant’s eCommerce site.

2: The payment gateway pushes the transaction information to the buyer’s credit card network and routes information to its issuing bank

3: The issuing bank applies fraud detection procedures to determine the authenticity of the transaction and confirms the buyer has sufficient credit in their account to make a purchase.

4: Issuing bank After the authentication is done, send information of approval(reject) back to the payment gateway.

5: the payment gateway then sends the approved or declined message to the merchant’s bank and make the payout accordingly (Major payment gateway takes a couple of business days to make a payout)

Manual Payment Gateway

A customer has other methods like Direct Bank Transfer, Cash, Cheque, or on Phone when he is not willing to pay online.

How to Pick a Payment Gateway?

With the right payment gateway, it becomes very easy to make online payments. Choosing the right payment gateway takes a little time but pays in the longer run. Please keep the following points in mind while choosing:

Cost– it is the main factor you should keep in mind. The cost involves setup fees, monthly fees, and transaction fees, etc.

Types of cards – Visa and MasterCard are most commonly used, but it is recommended to look out first.

Holding time– it varies from bank to bank, the normal holding period is -1-7 days.

Supported currency– if you are making international transactions, check if the payment gateway supports multiple currencies or not.

Best International Payment Gateways Compared

List of top 5 Payment Gateways

- Payline

- Stripe

- Authorize.Net

- PayPal

- 2Checkout

Let’s now dive into the two of the best payment gateways and compare their characteristics:

| Features | PayPal | Stripe |

| Payment processing speed | Processes transactions immediately | Processes transactions immediately |

| Merchant account | Not required | Not required |

| Security Compliance | PCI DSS certificate, fraud, and chargeback prevention | PCI DSS certificate, fraud, and chargeback prevention |

| Payment methods | 7 | 23 |

| Chargeback fee | $20 | $15 |

| Recurring billing | $10/Month | A free or paid plugin for $39.95 |

| Additional fees | None | None |

| The number of currencies | 25 | 100+ |

Best Indian Payment Gateways Compared

Below is the list of best payment gateways currently available in India for online transactions. Let’s take a look.

- CC Avenue

- PayU Money

- Razorpay

- Instamojo

- EBS

- Cashfree

Top 3 Mobile Wallets in India

- Paytm

- Mobikwik

- Fone paisa

Let’s now dive into the two of the best payment gateways and compare their characteristics:

| Features | RazorPay | Instamojo |

| Yearly and setUp Fees | 0 | 0 |

| Transaction Fees | 2%-3% per successful transaction | 2%+INR3 per transaction / 5%+INR3 for digital goods |

| Security Compliance | PCI compliant, fraud detection, 2 Factor Authentication | PCI compliant, fraud detection, 2 Factor Authentication |

| Payment methods | T+3 business days | 3 business days |

| Credit Card, Debit Card, Netbanking | yes | yes |

| Cards Processing Charges | 2% | 2%+INR3 per transaction / 5%+INR3 for digital goods |

| International Transaction | 3% | 3% |

| Recurring Payments | Yes | No |

A payment gateway is an essential part of any e-commerce business, choosing the right platform can be a problem. It is recommended to check out a few best options and select the one that suits best to your requirements.

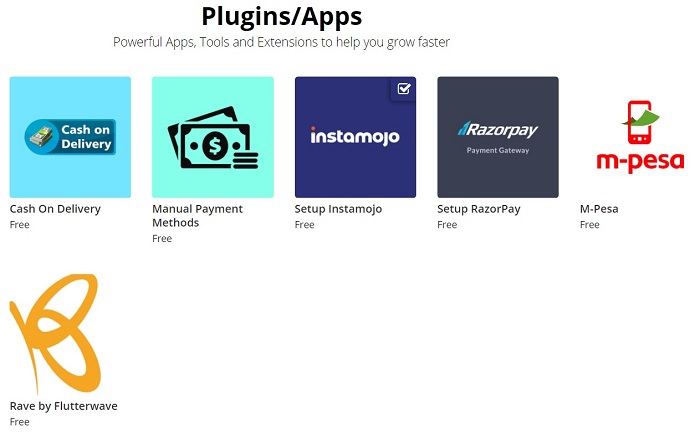

How MorecustomersApp Offers All the Major Gateways

MoreCustomersApp is a complete eCommerce solution that offers all major gateways for its customers. Now you don’t have to worry about making an online payment, MoreCustomersApp offers state-of-the-art and hassle-free online payment options for its valued customers.